Ensuring privacy, security, interoperability, and efficiency are essential in digital financial systems that leverage distributed technologies. In the context of tokenized assets and central bank digital currencies (CBDCs), these challenges become even more complex, requiring architectures that reconcile regulatory requirements with technological innovation. One example of this approach is the Ptah framework , designed to operate with privacy by design and composability on Regulated Tokenized Asset Networks (RTMNs).

Challenges in Regulatory Networks

of Digital Assets

The growing adoption of tokenized assets requires adaptations to distributed data management. Regulated networks, such as those proposed in the Drex project, require solutions that simultaneously meet the need for operational integrity and privacy requirements. To this end, approaches based on cryptographic compartmentalization and minimalist access control represent viable paths.

Traditional architectures, usually centralized or with insufficient privacy models, do not fully meet the demands of decentralization. In addition, these systems face practical difficulties in integrating with legacy systems and in their scalability. In this scenario, the Ptah framework presents a structured solution for handling digital transactions in a secure and interoperable manner.

The Ptah Framework and Its Architectural Principles

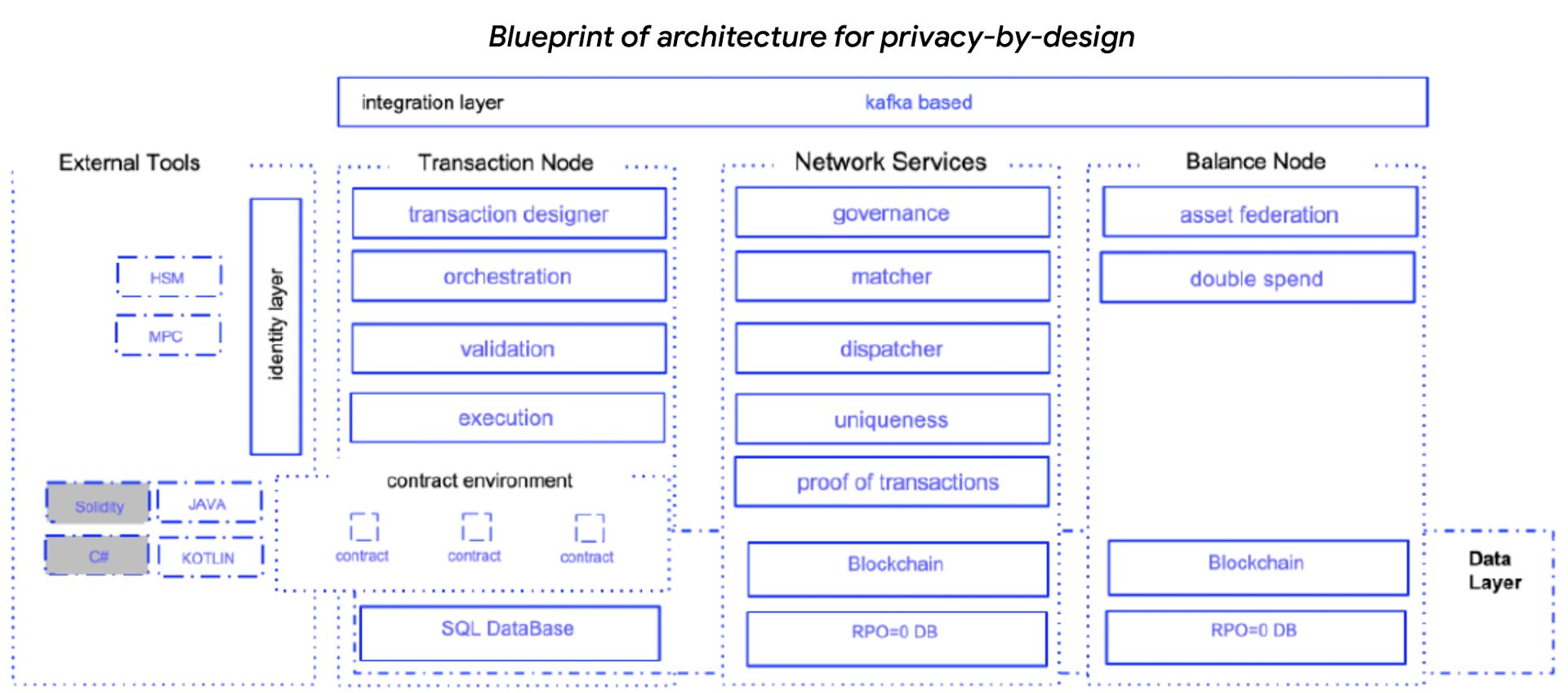

Ptah was developed to implement a distributed and modular approach in financial networks. Its main differentiator lies in the use of cryptographic compartmentalization , which ensures that network components only handle the data necessary for their direct operational functions. This reduces the possibility of unauthorized access, promoting privacy as a structural element.

The main technical aspects of the framework include:

Atomic Transactions: Through a Two-Phase Commit protocol, Ptah ensures that no partial transaction impacts the state of the network.

Composability and Modularity: Independent components such as validators, orchestrators, and balancing nodes interact through standardized interfaces. This approach makes it easier to build complex financial flows.

Privacy and Segmentation: Each service in the architecture has restricted access to specific data. For example, signature validators do not access transaction details, while orchestrators only manipulate metadata.

Application in the Drex Project

In the context of Drex , the CBDC platform of the Central Bank of Brazil, Ptah has been applied to use cases such as the trading of Tokenized Public Securities (TPTs) and CBDC. This application highlights features of the framework in a practical way and allows analyses focused on operational gains.

Ptah was also selected for Lift Lab 2025, an initiative of the Central Bank of Brazil and FENASBAC.

Trading Tokenized Assets

When multi-asset transactions occur, such as TPTs and CBDCs, these transactions involve multiple participants and require convergent validation. At Drex, the Ptah framework has enabled:

- Movement Orchestration: The framework coordinated simultaneous transfers between different participants, using multiple "Balance Nodes" and ensuring atomicity;

- Cryptographic Validation: Signatures of authorized parties were processed by decentralized services, minimizing exposed data;

- Regulatory Efficiency: Information required for compliance was preserved but selectively displayed without compromising participant privacy.

These operations demonstrate that Ptah supports scenarios with high security requirements and technical complexity.

Global Context and Expansion Perspectives

The principles employed in Ptah enhance integration in global scenarios. Projects such as mBridge , led by the Bank for International Settlements (BIS), could benefit from the modularity and interoperability provided by frameworks designed around distributed ledgers. The use of standards such as ISO20022, combined with modern techniques such as zk-rollups , supports scenarios that require high scalability and legal compliance.

Furthermore, for future upgrades, Ptah is capable of integrating quantum-resistant cryptography and decentralized identification mechanisms. These implementations broaden its applicability in highly distributed and regulated global financial systems.

Additional Cases in the Context of DREX that used the Ptah framework within their privacy tests:

- CCBt: the framework was applied in the cycle from issuance to trading of Tokenized Bank Credit Notes, within the pilot in phase II at gate 7 led by ABBC with the participation of more than 16 banks within the consortium. Encompassing issuance, trading in the secondary market as well as use as collateral for guarantees, encumbrance.

- Issuance of Private Securities: In the issuance of private debt securities, issued by companies via financial institutions, within the context of Drex, it was also validated using the Ptah framework.

In both cases it was used against a CBDC network, as a currency issuance, for direct settlement in a transparent and atomic way and subsequently the execution evidence was recorded against it.

Final Considerations

The development of solutions such as Ptah highlights the technical feasibility of regulated infrastructures associated with distributed technologies. Its modular architecture, based on principles such as compartmentalization and atomicity , meets security and privacy requirements, promoting interoperability in heterogeneous ecosystems .

Future studies could explore new implementations adapted to regional legislation and hybrid contexts, deepening the incorporation of tools such as confidential computing and decentralized oracles. These research directions are fundamental to sustaining necessary advances for the scalability and security of future financial networks.

Published paper:

Applying a Distinguished Framework to Ensure Privacy-by-Design and Composability in a Regulated Tokenized Multi-Asset Network

Sources of information in which BBChain Ptah was cited:

https://tiinside.com.br/16/07/2025/bbchain-lanca-framework-ptah-para-impulsionar-redes-financeiras-tokenizadas/

https://bitcoinblock.com.br/2025/07/30/bbchain-lanca-framework-ptah/

https://br.cointelegraph.com/news/crypto-news-bitgo-and-brazilians-in-the-european-market-bitget-wallet-vortx-buys-graphene-payments-and-other-news

https://valor.globo.com/financas/criptomoedas/noticia/2025/08/15/drex-para-que-servira-a-iniciativa-sem-dlt.ghtml

To learn more about BBChain, its products and services, visit: bbchain.com.br